The fact sheet for insured persons (PDF, 294 kB, 09.12.2025) (in German) explains how the AHV reform effective January 1, 2024, will affect women's entitlement to unemployment benefits as a result of the change in the reference age.

Effects of the AHV reform

Early receipt of an AHV retirement pension no longer automatically excludes entitlement to unemployment benefits.

The information sheet Unemployment approximately four years before the AHV reference age (PDF, 254 kB, 23.12.2024) explains the provisions of the Unemployment Insurance Act (UIA) regarding unemployment approximately four years before the AHV reference age.

What to do if you are unemployed?

Almost the entire working population of Switzerland (except those who are self-employed) is insured for unemployment as a mandatory requirement. The obligation to pay contributions is regulated by the federal act on OASI. The income is insured by the unemployment insurance scheme (UI) for those who earn an average monthly income of at least CHF 500.

Self-employed people are not insured.

The insurance entitlement does not apply to people who are employed but who, in their position as a Board member in an AG, or a partner in a GmbH, or as participants in the financing of the business, or as members of a top-level operational decision-making committee, determine or can significantly influence the decisions of the employer. This also applies to their spouses or registered partners if they also work for the company. You can ask at your implementing authority for more details.

If you’re Swiss, or if you’re a foreign national with a long-term residence permit in Switzerland, and you were working abroad as an employee, or you studied abroad, or you’re unable to work for another reason, please see Question 2.

The entitlement to unemployment benefit starts after completing compulsory education and ends on reaching the statutory retirement age (reference age).

The entitlement to unemployment benefit (UB) depends on the following conditions:

Unemployment status

You have to be partly or fully unemployed. You are also insured if you have a part-time position and you are looking for a full-time position or an additional part-time position. It’s important to remember that you’re only considered to be unemployed once you’ve signed on for employment services with the RAV (regional employment centre). You can do this online at www.work.swiss (signing on and registration) or in person at your nearest RAV.

Work stoppages/loss of earnings

You have to have at least 2 days of work stoppage and the corresponding loss of earnings.

Residence in Switzerland

You have to be resident in Switzerland. As a foreign national, you’ll need to have a valid temporary or permanent residence permit. If you live abroad and work in Switzerland (as a cross-border commuter), you will usually receive your

unemployment benefit in the country where you’re resident, and according to that country’s regulations.

Working age

You have to have completed your compulsory schooling and be below the statutory retirement age and not be drawing an old- age pension (OASI), referred to as the ‘reference age’.

Qualifying period for contributions

You have to prove that you’ve paid contributions for at least 12 months during the past 2 years (qualifying period for contributions).

The qualifying period for contributions may be extended under certain conditions. This is reviewed if you’ve given up self-employment or are raising children under the age of 10.

The qualifying period for contributions also includes:

- Working as an employee in Switzerland in a position that is subject to contributions;

- Contribution period in an EU/EFTA country as an EU/EFTA citizen, if you last worked as an employee in Switzerland in a position subject to contributions; For cross-border commuters living in Switzerland, the contribution period is counted even if the last position subject to contributions was not in Switzerland;

- Working as an employee in a position subject to contributions for a Swiss company abroad (posting);

- Swiss military, civilian or civil defence service.

Insufficient qualifying period

Even if you fail to meet the qualifying period for contributions, you are still insured if you were unable to work for a total period of more than 12 months due to...

- Education, provided you have been resident in Switzerland for at least 10 years;

- Illness, accident or maternity, provided you were resident in Switzerland during that period;

- Staying at a Swiss psychiatric hospital.

You are also insured, but exempt from contributions...

- if you lived and worked in a non-EU/EFTA country for longer than 1 year;

- if you are a Swiss citizen or a citizen of an EU/EFTA country with residency in Switzerland, and

- you are able to provide proof that you paid contributions in Switzerland for 6 months within the 2 years prior to registering for unemployment insurance.

For citizens of non-EU/EFTA countries with residency in Switzerland, residency periods outside Switzerland lasting longer

than 1 year will be taken into consideration.

You’re also insured without having to pay contributions if you are compelled for one of the following reasons, or a similar reason, to take on or expand the scope of a non-self-employed position, the incident occurred no more than one year ago, and you were resident in Switzerland when it happened:

- Divorce or ending of a civil partnership;

- Separation (marriage or partnership);

- Death of a spouse or registered partner;

- A disability allowance was reduced or came to an end

Fit for placement

You must be fit for placement, that is to say willing and entitled to take on a reasonable job and to participate in integration measures (see the ‘Labour market measures: The first step to re-joining the labour market’ information service, no. 716.800).

Monitoring rules

As per the RAV regulations, you must attend the information day and subsequent counselling and follow-up meetings in person. You also have to make every reasonable effort to avoid becoming unemployed and minimise the time you spend out of work (see Questions 4 and 5).

You’ll find information on the available unemployment insurance funds at work.swiss (see Signing on and registration and Addresses/ contact) or from your RAV. Once you’ve chosen one, this is binding for the whole reference period for benefit entitlement.

To check your claim, the unemployment insurance fund will require various documents:

The form ‘Application for unemployment benefit’should preferably be submitted via the relevant eService. Once you have done this, you can submit additional supporting documents the same way. If you haven’t opened an account on Job-Room within a week of signing on with the RAV, you will receive the form by post.

The necessary documents include:

- The form ‘Application for unemployment benefit’

- Employer’s certificates from the last 2 years

- Other information required by the unemployment insurance fund

- The form ‘PD U1’ if you’ve come to Switzerland from an EU/EFTA

country

At the end of every month, you must submit the following documents to your unemployment insurance fund:

- The form ‘Details of the insured person’

- Other information required by the unemployment insurance fund

Only the relevant eService or the paper form issued by the unemployment insurance fund may be used to submit the form ‘Details of insured person’. If you require a duplicate ‘Details of the insured person’ form – for example because you have

lost yours or haven’t received one by the 25th of the month – please contact your unemployment insurance fund directly.

Using the eServices makes it quicker and easier for the unemployment insurance fund to process your data. The eServices guarantee secure and confidential transmission of your data.

The published forms should preferably be completed on a computer and only printed out to sign.

The eServices and published forms are available at www.work.swiss (see eServices and forms for unemployment benefit).

Claims that are not submitted within 3 months will expire.

- As part of your obligation to cooperate, you have to provide, free of charge, all the information that is required to examine your claim. This also includes informing your unemployment insurance fund and the RAV of any changes that affect your claim. These may be, for example, temporary employment, taking up self-employment, illness or accident, the birth of a child, IV proceedings, etc. The implementing agencies rely on documents that are complete, correctly filled and submitted on time. Without this information the unemployment insurance fund cannot correctly calculate your unemployment benefit and pay it out on time.

- As part of your duty to minimise the benefits paid out, you must make every reasonable effort to avoid becoming unemployed and to minimise the time you spend out of work. You have to make targeted efforts to find a new job before you become unemployed, generally in the form of a formal job application – if necessary outside of your former occupation. Applications when no specific vacancy has been advertised (speculative applications) may also be sent, but are considered supplementary. You must submit your efforts to find work to the RAV on a monthly basis. You must accept a reasonable job when offered (see Question 5).

- You’re required to inform your RAV and your unemployment insurance fund at an early stage of any work performed while drawing unemployment benefit.

- Supplying untrue or incomplete information may lead to your benefits being withdrawn and to criminal charges. Benefits drawn illegally must be repaid.

In principle you have to accept any work without delay. A job that is deemed unreasonable, and that you therefore don’t have to accept, is one that...

- does not satisfy your usual working conditions;

- does not take due consideration of your skills and your previous line of work (this doesn’t apply to people under 30);

- does not suit your personal circumstances (age, health, family);

- hinders the reintegration in your own occupation, assuming there is a chance of that happening within a reasonable amount of time;

- provides you with an income that is less than 70% of the insured salary, unless you receive compensation payments to top up your temporary earnings (see Question 9).

You receive 5 days’ daily allowance per week (Monday to Friday). Because the number of working days varies from month to month1, the unemployment benefit (UB) that is paid out also varies accordingly. The level of the UB basically depends on the salary subject to OASI contributions that you received on average in the last 6 months – or if more advantageous, 12 months – before you became unemployed (= insured salary)2.

You will receive a UB amounting to 80% of the insured salary if:

- You have dependent children aged under 25;

- Your insured salary does not exceed CHF 3,797;

- You are drawing a disability allowance which corresponds to a degree of disability of at least 40%.

In all other cases you will receive a UB amounting to 70% of the insured salary.

If you have dependent children aged under 25, you are in principle entitled to child and education allowances. The level of the allowances is set by the family allowance laws of the respective canton.

The statutory social insurance contributions3 and, in the case of foreign nationals, any withholding tax that may apply, are to be deducted from the unemployment benefit.

Daily allowance for those who are exempt from contributions

If you’re exempt from complying with the qualifying period for contributions (see Question 2 ‘Insufficient qualifying period’), your daily allowance is 80% of your flat-rate amount, which will be CHF 153, 127, 102 or 40 per day depending on your level of qualification and age. These amounts will be reduced by half if the reason why you are exempt from the contribution period is being in education, retraining, further training or on completing an apprenticeship, and you are under 25 and don’t have any dependent children.

1The number of working days in a month varies from 20 to 23; the average is 21.7 days.

2If there are large fluctuations in the salary, the average figure is used.

3Social insurance contributions: Contributions to the statutory pension schemes OASI/DI/LoE(OASI = old age and survivors insurance, DI = disability insurance, LoE = loss-of-earnings compensation), the obligatory non-occupational accident insurance, and to the occupational pension. This is to prevent gaps in the contributions and insurance. Your unemployment insurance fund will arrange what is required. Please note that the OPA contributions cover the risk of disability and death, but not old-age/retirement. You’ll find more information about occupational pensions in the Info-Service «Berufliche Vorsorge für arbeitslose Personen» (Nr. 716.201) (PDF, 77 kB, 03.01.2023).

The Unemployment Insurance Act (UIA) stipulates a maximum period for drawing an allowance of 2 years. The reference date for the start of this qualifying period is the first day on which you meet all eligibility requirements (see Question 2).

The unemployment insurance fund (UIF) usually pays the daily allowance for each month in the course of the following month. You’ll receive a written statement. To ensure prompt payment of the daily allowance, it is important that you submit all the required documents to the unemployment insurance fund as soon as possible (see Question 3).

You work on a self-employed or non-self-employed basis and earn an income that is less than your unemployment benefit (UB). The income earned from this work is referred to as temporary earnings. Your UB (compensation payment) amounts to 80% or 70% of the difference between the temporary earnings earned and the insured salary, for a period of at least 12 months (see Question 6). The temporary earnings must be paid in the usual way for the location and occupation.

It is always beneficial for you to have temporary earnings, because by doing this...

- you improve your income as the temporary earnings plus the compensation payment from the UI is always higher than the UB;

- you get the chance to gain more professional experience and to make interesting contacts. In addition, it’s easier to find a new job when you’re already in work;

- you earn new contribution periods. You do not normally earn any contribution periods from participation in a labour market measure funded by the UI.

If you fail to meet your obligations, your entitlement will be temporarily suspended. This means you will not receive any daily allowances for a certain period of time.

This is specifically the case if you....

- become unemployed through your own fault;

- do not make sufficient efforts to find a reasonable job;

- do not comply with the monitoring requirements/directives of the RAV, in particular by not accepting reasonable allocated work, by not attending or cutting short a labour market measure for no good reason, or by undermining the effectiveness of the measure or making it impossible;

- fail to comply with your obligations to report and provide information;

- obtain unemployment benefit unlawfully (just attempting to do so is enough).

The suspension lasts for 1 to 60 days depending on the degree of fault. Only the days on which you satisfy all the eligibility requirements are counted as days of suspension (see Question 2). If the entitlement is suspended repeatedly, a longer period of suspension will be set.

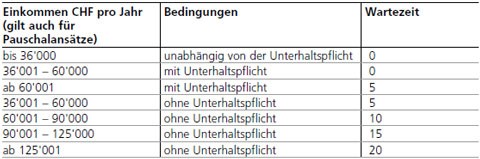

The first daily allowance payment is only paid out after the waiting period days, similar to a deductible. Only the days on which you satisfy all the eligibility requirements are counted as waiting period days (see Question 2).

In principle the entitlement to unemployment benefit starts after a standard waiting period of 5 days of monitored unemployment.

In certain cases it may be necessary to observe the following special waiting period days in addition to the standard ones:

- 1 day, if you were working in a seasonal job or in a profession where frequently changing or short-term contracts are common, before your time of unemployment;

- 5 days, if you’re specifically exempt from the contribution period due to a long-term illness, maternity, an accident, the disability or death of a spouse, separation, divorce, a stay in a Swiss psychiatric hospital, or returning from a working visit abroad (see Question 2 ‘Insufficient qualifying period for contributions’);

- 120 days, if you are exempt from observing the contribution period due to education, retraining, or further training.

After 60 days of monitored unemployment, you are entitled to 5 days of ‘leave from monitoring’ (1 week). These are days when you don’t have to comply with the monitoring rules, don’t have to make any efforts to find work, and don’t need to be ready for a job placement. You can also save up the 5 monitoring-free days, for example in order to use 10 days of ‘leave from monitoring’ (2 weeks) after a period of 120 days of monitored unemployment.

You have to inform your RAV 2 weeks in advance when you’re using your leave, which is generally taken on a weekly basis.

You can’t carry forward any monitoring-free days that you don’t use before the qualifying period ends to a subsequent qualifying period. The monitoring-free days that are not used can’t be paid out in the form of cash, either when changing the qualifying period or when starting employment.

You must report your incapacity to work due to illness, accident or pregnancy to the RAV within 1 week, and declare it on the form 'Details of insured person', or, if you have already submitted the form for the relevant month, report it to the unemplyoment insurance fund. From the 4th day you must present both authorities with a medical certificate.

For an accident, you also have to notify your unemployment insurance fund, and if you were taking part in a labour market measure, the organiser. This should be done using the form 'Meldung Unfall während Arbeitslosigkeit' ('Report an accident during unemployment').

In the event of an accident, you will receive benefit payments from the unemployment insurance for the first 3 days (incl. the day of the accident). After this you receive the daily allowance from Suva (the Swiss National Accident Insurance Fund).

In the event of incapacity to work due to illness or pregnancy, you’re only entitled to unemployment benefits for the first 30 calendar days of your incapacity to work. The daily sickness allowance is limited to 44 days' daily allowance within the reference period for benefit entitlement.

You must report maternity, paternity or care leave to your RAV in good time.

You’re not entitled to unemployment benefit during maternity, paternity or care leave. You don’t have to fulfil any obligations with regard to the unemployment insurance during this period either.

Compensation during maternity, paternity or care leave is governed by the Loss of Earnings Compensation Act (LECA). Contact your OASI compensation office for more information (see also leaflets from the OASI/DI information centre, p.23).

If the compensation for loss of earnings during your Swiss military service or civilian service is for no more than 30 days, or during your civil defence service is less than your unemployment benefit, then the unemployment insurance fund will pay out the difference. This does not include military training schools, transport services or comparable services performed for other countries.

Read more at www.work.swiss (see Looking for work abroad) or ask at your RAV and read the Info-Service newsletter ‘Services for job searches abroad (PDF, 102 kB, 30.12.2025) (PDF, 99 kB, 02.04.2024)’, No. 716.204.

Every decision will include a note about the legal means of appeal, stating what you need to do if you don’t agree with it. In principle the appeals process is free of charge.

You can’t contest a daily allowance statement directly. If you don’t agree with a statement, you have to request a formal decision subject to appeal within 90 days from the time when you received it. You should state which point it is that you don’t agree with.

In any case we recommend that you first arrange for a consultation with the instance issuing the decision before you submit a written appeal.

Other legal questions and competent instances

The unemployment insurance scheme is implemented on a decentralised basis. SECO is the supervisory authority for unemployment insurance, but its tasks do not include making statements in response to decisions or rulings of the competent enforcement offices (RAVs, unemployment insurance funds, cantonal offices). They are responsible for deciding on specific cases and providing information.

The cantonal employment office of the canton in which the place of business is located or where the company has its registered office, is responsible for deciding on applications for short-time working compensation. The cantonal employment office of the canton in which the place of business is located is responsible for deciding on applications for bad weather compensation. If you have any questions please contact the applicable office directly.

Claiming the compensation

The unemployment insurance fund which you chose is responsible for providing information about claiming the compensation.

The unemployment insurance fund which you chose is responsible for providing information about the entitlement to daily allowances, how they are calculated incl. temporary earnings, and the suspension of entitlement in the case of unemployment through the person's own fault (e.g. as a result of giving notice without first having a new position ready). If you are not yet registered, contact the public unemployment insurance fund of your canton or an unemployment insurance fund of an employees’ or employers’ organisation of your free choice.

If you do not agree with the benefits statement issued by your unemployment insurance fund, you have to request a ruling within 90 days from the time you receive it. You can appeal against this in writing to the unemployment insurance fund, which will then examine your case again and issue a decision on the appeal. Should the decision about the appeal not agree with your expectations, you can take the case further to the cantonal Insurance Court and then if necessary to the Federal Court.

If you do not agree with a ruling of your unemployment insurance fund, for example concerning your entitlement to benefits, you can lodge an appeal directly and then a complaint.

For appeals and complaints it is important to state the result that you hope to achieve (petition) and to briefly explain why (statement of grounds). You have to enclose the contested decision and any documents you cite and that are in your possession.

Instead of an appeal or standard complaint you can also submit a supervisory complaint. If your unemployment insurance fund does not issue a benefits statement, ruling or decision about the appeal for a period of several months, you can submit a complaint for denial of rights or delay in granting rights, directly to the cantonal Insurance Court.

The regional employment centre (RAV) will advise you personally – already before the time of unemployment or during it. Your RAV personnel consultant will work with you to try and find a suitable position for you as quickly as possible. The RAV is the right point of contact for information about training and employment measures, as well as cases of suspension of entitlement due to insufficient efforts to find work.

If you do not agree with a ruling of the regional employment centre or cantonal employment office, you can submit an appeal – at the instance indicated in the legal notice on rights of appeal – and if necessary take the case further by contesting the decision about the appeal at the cantonal appeals instance (Insurance Court, appeals committee) and then finally at the Federal Insurance Court in Lucerne.

Important: If you are instructed to attend a labour market measure such as a course, employment programme etc., you cannot contest this directly, but only if you are issued with a suspension of benefits ruling because you failed to attend through no fault of your own or the labour market measure had been cancelled.

For appeals and complaints it is important to state the result that you hope to achieve (petition) and to briefly explain why (statement of grounds). You have to enclose the contested decision and any documents you cite and that are in your possession.

The appeal process is free of charge provided the dispute relates to insurance payments and not formal matters, and the accusation of wilful misconduct of the proceedings does not have to be made. Instead of an appeal or standard complaint you can also submit a supervisory complaint. If your RAV does not issue a ruling or decision about the appeal for a period of several months, you can submit a complaint for denial of rights or delay in granting rights, directly to the cantonal appeals instance (cantonal Insurance Court, Appeals Committee).

We recommend that you first contact your RAV personnel consultant for a discussion and tell them about your concerns. Perhaps you will be able to find a solution together. Otherwise you can usually put in a request to your RAV personnel consultant or your RAV management to change the RAV personnel consultant.

If there are still problems in your inter-personal relationship, you have the option of lodging a supervisory complaint with the respective body responsible for the enforcement office. The responsible body for the public unemployment insurance fund, the cantonal employment office and the RAV is the canton or local government. The responsible body for the private unemployment insurance fund is the employee or employer organisation which manages the unemployment insurance fund.

Do you have any questions about your giving notice to leave your job, or about a possible insurance cover for the period after you leave your job? Regarding these and similar issues please contact an advisory centre that specialises in employment law and social insurance law.